BIG DEAL: 60% OFF - The Lead Magnet Starter Kit CLICK HERE.

This Post May Contain Affiliate Links. Click Here To Learn More.

I know you’re probably thinking, “Is it really possible to raise my credit score 100 points in only one year?” The answer is… YES! Results are not guaranteed, but I’ve done it and so have a bunch of my clients, students, fans, followers and friends based upon the steps I’m about to show you from my 30 day B Money Financial Challenge.

First let’s talk about credit cards with high interest rates. Because I suggest that you pay off your debt with the lowest balances first, you may worry about neglecting your credit cards with high interest rates. There are a couple ways to get your interest rates down.

Option #1: Call your credit card company(s) and negotiate for lower rates.

Option #2: Transfer the balance of your higher interest rate credit card(s) onto a lower interest rate card. Wondering how to do a balance transfer? Here’s how: Go to bankrate.com and search for a balance transfer card. Look for cards that offer a 0% interest rate for at least 6 months and the lowest transfer fee available. Take note, when doing a balance transfer, credit card companies will often charge you a fee – about 3% of the total balance. Also note that sometimes credit card companies run a special where you can transfer your balance without a fee. That’s the type of deal you’re looking for on bankrate.com.

ONCE YOU FIND A CARD YOU’RE INTERESTED IN, CALL THE COMPANY AND ASK:

- How long is the 0% introductory rate?

- What will my rate be after the introductory rate expires?

- How much is the transfer fee?

- What happens if you’re late with a payment?

- Is there any fine print you should know about?

NOW HERE’S THE STEP BY STEP GUIDE TO YOUR DEBT REPAYMENT PLAN:

- Pay down debt (30% of your score)

- Pay your bills on time (35% of your score)

- Auto-pay off a small debt to bring its balance to $0 every month; this is where the magic happens. This one step will make your credit score jump like Jordan.

- Become an authorized user on a credit card account in good standing

The Good News: When you’re added as an authorized user, the account will appear on your credit reports, too. If the account remains positive with a low balance, it can help you establish and improve your credit history.

The Great News: An authorized user has permission to use the credit card, but is not responsible for any of the debt.

The AWESOME News: If the account is reported and there are delinquencies appearing on the account, it is likely that the delinquencies are affecting your scores. However, because you are not responsible for the debt, credit scoring companies will remove authorized user accounts that become delinquent.

The account may be removed automatically, but if you find it is still being reported, follow the dispute instructions provided with your credit reports and request that it be deleted. Basically, authorized users get all of the benefits and none of the risks.

Bonus Tip: If you consistently keep your credit card balances below 30% of your credit limits, this will help to tremendously raise your score too. This means if your limit is $1000, keep your balance below $300. Also, don’t forget to get your Trans Union score for FREE via Credit Karma, and use their FREE service to help you monitor your progress. They offer tips on how to improve your score as well. And did I mention it is all free!

If you need more help, I recommend reading the book “What the FICO: 12 Steps to Repairing Your Credit” by Ash. This book was by far the best & simplest book I’ve ever read about credit. I actually learned some things that I didn’t know! I was blown away at some of the steps and tips shared. If you’re having problems with your credit don’t walk to get the book, run. You’ll see.

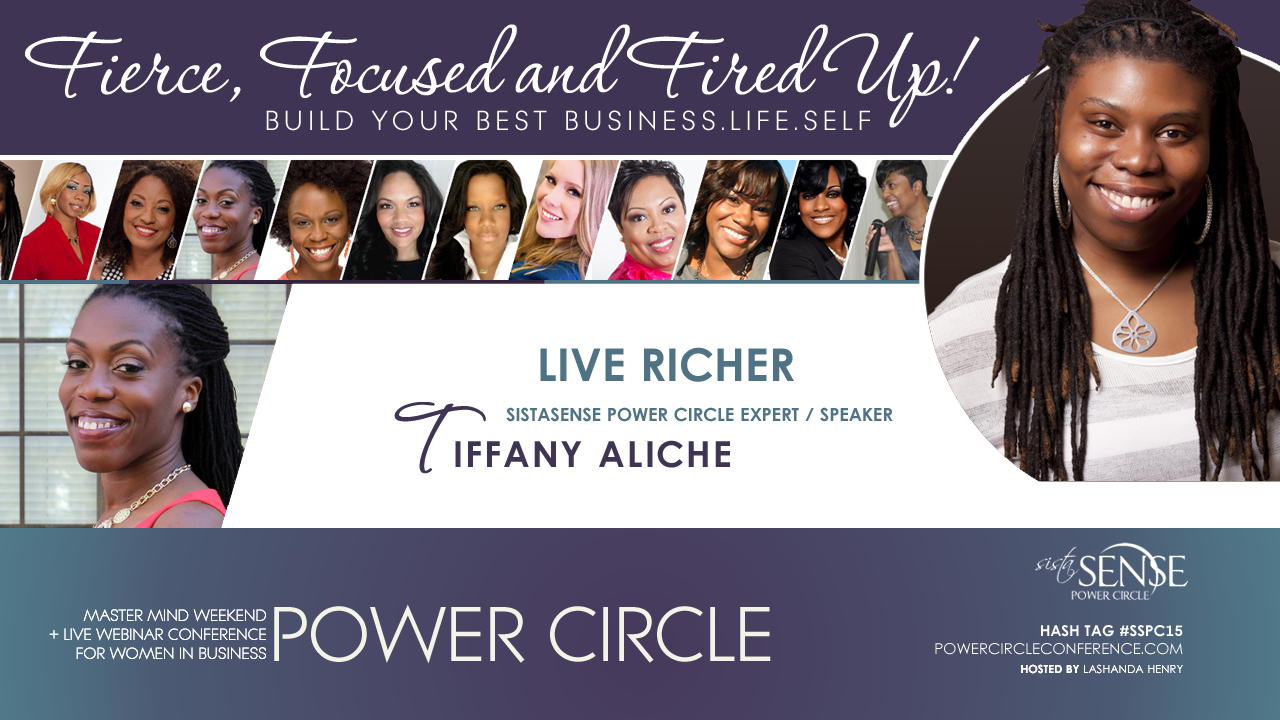

Power Circle Expert Tiffany “The Budgetnista” Aliche shares in an exclusive SistaSense Interview on what it means to Live Richer and boost your financial fitness for the new year inside the SistaSense Power Circle – Fierce, Focused, Fired Up Live Webinar Conference – join us live or access replays.

Tiffany is an award-winning teacher of financial empowerment. Visit her at thebudgetnistablog.com to join the movement and get free financial help now.

Plus sign up for the LIVE RICHER Challenge at www.livericherchallenge.com. It’s a free online financial challenge created by the Budgetnista to help 10,000 women achieve 7-specific financial goals in 36 days.

QUESTION: Do you need to create more content? CLICK HERE for help.

Best Ring Light for Recording Videos on Your Phone

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

Perfect Password Book

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

6 Sales Tools I Use to Run My Business

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

(challenge) Create 30-Days of Social Media Content

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

Freebie Lead Magnet Ideas and Sale Boosters

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

List-Building Made Easy: Fresh Alternatives to Creating Lead Magnets

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

Quick Content Marketing Ideas for Entrepreneurs

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

How to Create 100 Pieces of Content in One Day

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

Best Ring Light for Recording Videos on Your Phone

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

Perfect Password Book

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]

6 Sales Tools I Use to Run My Business

Share Tweet Post Email More BIG DEAL: 60% OFF - The Lead Magnet Starter Kit [...]